Does your company do business across state lines? If so, it’s a good idea to reexamine your sales tax obligations.

In its 2018 decision in South Dakota v. Wayfair, the U.S. Supreme Court upheld South Dakota’s “economic nexus” statute, expanding the power of states to collect sales tax from remote sellers.

Today, nearly every state with a sales tax has enacted a similar law, which makes it prudent for companies doing business across state lines to review their tax obligations.

South Dakota’s economic nexus statute was upheld, but what’s nexus? A state is constitutionally prohibited from taxing business activities unless those activities have a substantial “nexus,” or connection, with the state.

Before Wayfair, simply selling to customers in a state wasn’t enough to establish nexus. The business also had to have a physical presence in the state, such as offices, retail stores, manufacturing or distribution facilities, or sales reps.

In Wayfair, the Supreme Court ruled that a business could establish nexus through economic or virtual contacts with a state, even if it didn’t have a physical presence.

The Court didn’t create a bright-line test for determining whether contacts are “substantial,” but found that the thresholds established by South Dakota’s law are sufficient.

Out-of-state businesses must collect and remit South Dakota sales taxes if, in the current or previous calendar year, they have

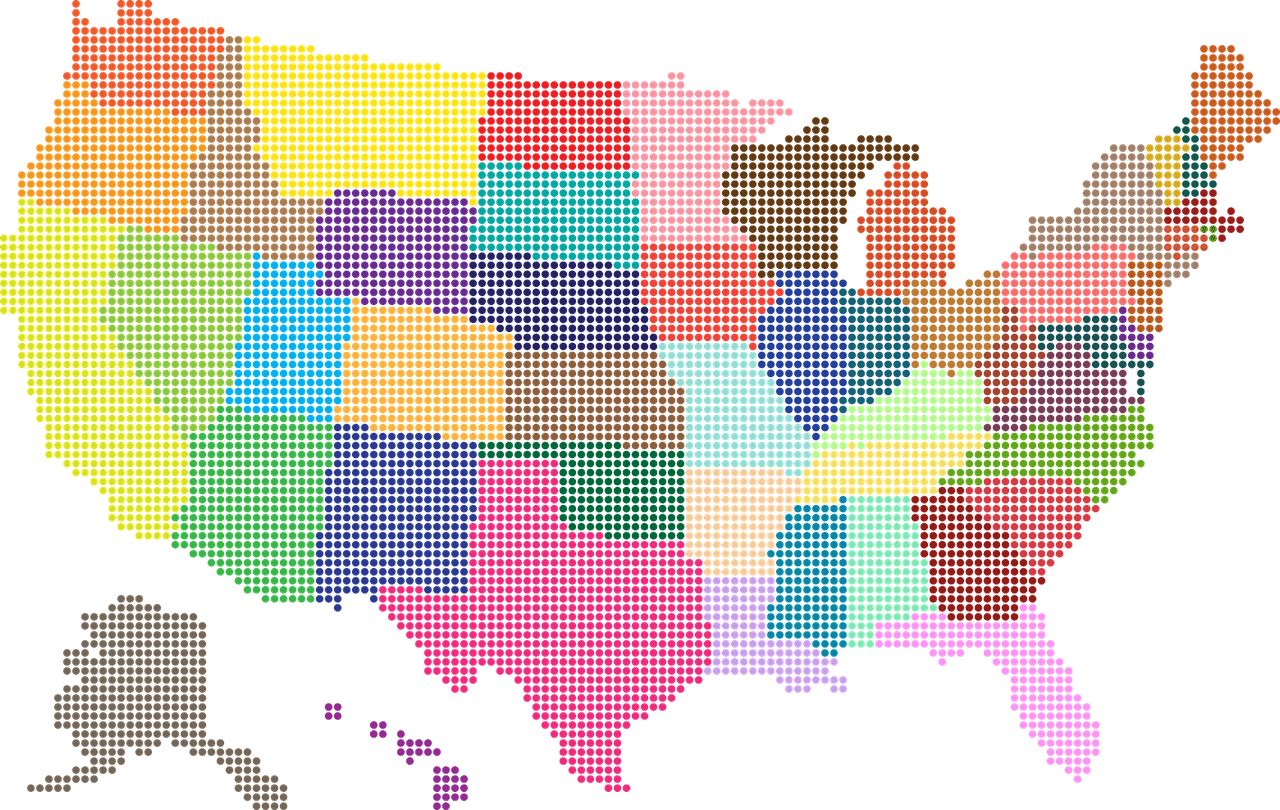

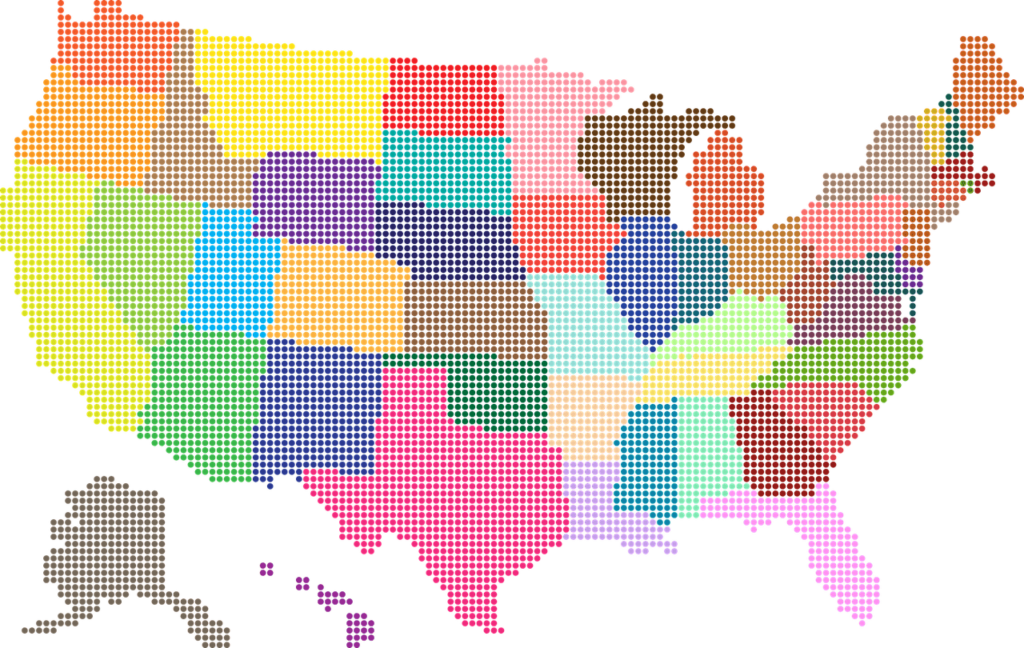

The vast majority of states now have economic nexus laws, although the specifics vary. Many states adopted the same sales and transaction thresholds accepted in Wayfair, but a number of states apply different thresholds.

And some chose not to impose transaction thresholds, which many view as unfair to smaller sellers (an example of a threshold might be 200 sales of $5 each would create nexus).

In Illinois, Public Acts 101-0009 and 101-0604 “expanded nexus to include marketplace facilitators that meet certain thresholds effective Jan. 1, 2020.”

According to state officials, marketplace facilitators who meet state nexus thresholds are required to register to collect and remit Illinois Use Tax for sales made through their marketplace.

Marketplace sellers selling through the marketplace are not responsible for collecting and remitting Illinois Use Tax on these sales.

If your business makes online, telephone or mail-order sales in states where it lacks a physical presence, it’s critical to find out whether those states have economic nexus laws and determine whether your activities are sufficient to trigger them.

If you have nexus with a state, you’ll need to register with the state and collect state and applicable local taxes on your taxable sales there. Even if some or all of your sales are tax-exempt, you’ll need to secure exemption certifications for each jurisdiction where you do business.

Alternatively, you might decide to reduce or eliminate your activities in a state if the benefits don’t justify the compliance costs.

If you make sales through a “marketplace facilitator,” such as Amazon or Ebay, be aware that an increasing number of states have passed laws that require such providers to collect taxes on sales they facilitate for vendors using their platforms.

If you need assistance in setting up processes to collect sales tax or you have questions about your responsibilities, call David Mills, CPA, LLC. Our experts can help answer all your small business tax questions.

Contact David Mills, CPA LLC’s Morton or East Peoria offices today.